Published 10/2024

MP4 | Video: h264, 1920x1080 | Audio: AAC, 44.1 KHz

Language: English | Size: 638.13 MB | Duration: 2h 52m

Unlock the power of LLPs with this comprehensive global guide to LLP formation, advantages, and financial strategies!

What you'll learn

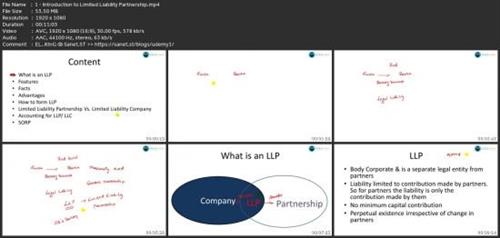

Introduction to Limited Liability Partnerships (LLPs): Students will be introduced to the concept of LLPs, understanding their structure, legal aspects.

Key Facts and Advantages of LLPs: The course will cover important facts about LLPs, highlighting their benefits, such as limited liability, tax advantages.

Formation of LLPs Globally: Students will explore how to form LLPs in various countries, including the UK, Singapore, and India.

Comparing LLP with LLC and Understanding LLP SORP: A detailed analysis of the differences between LLPs and LLCs.

Real-World Examples: The course includes practical examples to demonstrate the formation, management, and operations of LLPs.

LLP Regulations and Taxation: Students will gain an understanding of the legal and tax implications of LLPs, including income tax considerations.

Exhibits and Case Studies: The course incorporates a variety of case studies and exhibits to reinforce the learning process.

By the end of the course, students will have a strong foundational knowledge of LLPs, how to form them in various countries.

Requirements

Basic Understanding of Business and Finance: Familiarity with business structures such as corporations, partnerships, and sole proprietorships will help students grasp the concepts more easily.

Introductory Knowledge of Accounting: While not mandatory, a basic understanding of accounting principles (e.g., balance sheets, income statements, and taxation) will be helpful, especially for the sections that cover taxation and the financial structure of LLPs.

Interest in Business Law and International Regulations: A keen interest in business law, especially in the context of company formation, tax regulations, and international business practices, will aid in comprehending the global differences in LLP regulations.

Familiarity with Online Learning Platforms: Since the course will be delivered through video lectures and online resources, students should be comfortable navigating e-learning platforms and using multimedia resources for learning.

Description

This course offers a comprehensive guide to Limited Liability Partnerships (LLPs), focusing on their formation, advantages, and differences across various jurisdictions. It caters to students and professionals who are interested in understanding how LLPs function globally, comparing them with other business structures, and exploring the financial and operational advantages they provide. The course covers essential aspects of LLPs, including their creation in different countries, key regulatory frameworks, and real-world examples that illustrate their application in business.Section 1: IntroductionThis section serves as an introductory overview of Limited Liability Partnerships (LLPs). You'll learn about the fundamental concepts that make LLPs distinct from other business structures, including their legal framework and the benefits of limited liability for partners. By the end of this section, students will have a solid understanding of the core principles of LLPs and why they are popular for professional services firms and other businesses that require flexibility and liability protection.Section 2: Important Facts and AdvantagesIn this section, students will dive into the essential facts surrounding LLPs. The lectures cover the important regulatory aspects of LLPs and explore the numerous advantages they offer, such as limited liability, tax benefits, and management flexibility. Understanding these advantages will provide learners with insights into why many businesses prefer LLPs over other organizational structures, and how these benefits can be leveraged in different contexts.Section 3: Formation of LLPThis section focuses on the practicalities of forming an LLP, with an in-depth look at the processes in major business hubs around the world. From Singapore to the UK and India, students will learn the step-by-step process of setting up an LLP, including the regulatory requirements, registration procedures, and legal documentation needed for compliance. This comparative view allows students to see how LLP formation varies across countries and provides practical knowledge for those interested in international business structures.Section 4: LLC vs LLP and LLP SORPHere, students will explore the key differences between a Limited Liability Company (LLC) and a Limited Liability Partnership (LLP). The lectures will highlight their unique features, such as ownership structure, tax implications, and liability protection. Additionally, this section covers the Statement of Recommended Practice (SORP) for LLPs, guiding students through the financial reporting standards applicable to LLPs in the UK. Understanding SORP is crucial for anyone involved in the accounting and auditing of LLPs, and this section ensures a solid grasp of these reporting requirements.Section 5: Working ExamplesIn this section, students will apply the knowledge they've gained through a series of working examples. These real-world case studies demonstrate the formation, management, and financial reporting of LLPs across different industries and regions. Each example walks students through the practical application of LLP concepts, including liability management, profit distribution, and regulatory compliance. This section is designed to solidify understanding by presenting complex situations in an accessible, hands-on format.Section 6: ExhibitsThe exhibits section provides additional documentation and visual aids that enhance the learning experience. Students will explore various legal and financial documents related to LLPs, along with illustrative diagrams that explain the structure and operation of LLPs in practice. These exhibits serve as a valuable reference for students who need concrete examples of how LLPs function from a regulatory and operational perspective.Section 7: LLP in the US and IndiaThis final section compares the legal frameworks of LLPs in the United States and India. The lectures will examine the specific tax treatments and regulations governing LLPs in both countries, offering insights into how these entities are structured to suit local business needs. The section also delves into the income tax implications of LLPs in the US, as well as the considerations for related parties in these jurisdictions.Conclusion:The course concludes by summarizing the key concepts of LLP formation, advantages, and operational strategies across different countries. Students will leave with a deep understanding of how LLPs function globally and how to apply this knowledge in real-world business scenarios. The course provides a complete toolkit for anyone looking to master the intricacies of Limited Liability Partnerships, making it a must-take for professionals and students alike.

Overview

Section 1: Introduction

Lecture 1 Introduction to Limited Liability Partnership

Section 2: Important and Advantages

Lecture 2 Important Facts

Lecture 3 LLP Advantages

Section 3: Formation of LLP

Lecture 4 Formation of LLP

Lecture 5 Formation of LLP Continues

Lecture 6 Formation of LLP - Singapore

Lecture 7 Formation of LLP - UK

Lecture 8 Formation of LLP - India

Section 4: LLC vs LLP and LLP SORP

Lecture 9 LLP - LLC vs LLP

Lecture 10 LLP SORP

Lecture 11 LLP SORP Continues

Lecture 12 More on LLP SORP

Section 5: Example

Lecture 13 Working Example 1

Lecture 14 Working Example 2

Lecture 15 Working Example 3

Lecture 16 Working Example 4

Lecture 17 Working Example 5

Lecture 18 Working Example 6

Lecture 19 Working Example 7

Lecture 20 Working Example 8

Lecture 21 Working Example 9

Lecture 22 Working Example 10

Section 6: Exhibits

Lecture 23 Exhibits

Lecture 24 Exhibits Continue

Section 7: LLP - US and India

Lecture 25 LLP in US

Lecture 26 LLP in US Continues

Lecture 27 LLP in US - Income Tax and Related Parties

Lecture 28 LLP in India

Entrepreneurs and Business Owners: Those looking to start their own business or expand their knowledge of LLPs as a business structure for better risk management, tax advantages, and operational flexibility.,Business Students: Individuals studying business, finance, or accounting who want to deepen their understanding of business entities, particularly LLPs, and their legal, financial, and operational implications.,Legal and Accounting Professionals: Lawyers, accountants, or financial advisors who need to advise clients on the advantages, formation, and legal requirements of LLPs, especially those dealing with international markets like the US, UK, Singapore, and India.,Corporate Managers and Executives: Those in management positions looking to understand LLPs as an option for business expansion or restructuring, especially in global markets.,International Business Enthusiasts: Professionals and students interested in understanding how LLPs are formed and regulated in different countries, including cross-border taxation and compliance issues.,Small to Medium Business Owners: Individuals already running a small to medium enterprise (SME) who are considering restructuring their business into an LLP to minimize liabilities and enhance operational flexibility.

Screenshots

Say "Thank You"

rapidgator.net:

ddownload.com:

News

News